Transactional Insurance Solutions for Mergers & Acquisitions

Mergers and Acquisitions (M&A) activity can often present a unique array of legal, tax, and operational risks requiring expert advice to deliver bespoke solutions. W Denis, a specialist global insurance broker, provides tailored solutions that allow buyers, sellers, and their advisors to manage these risks effectively and efficiently, enabling deals to proceed with confidence. This […]

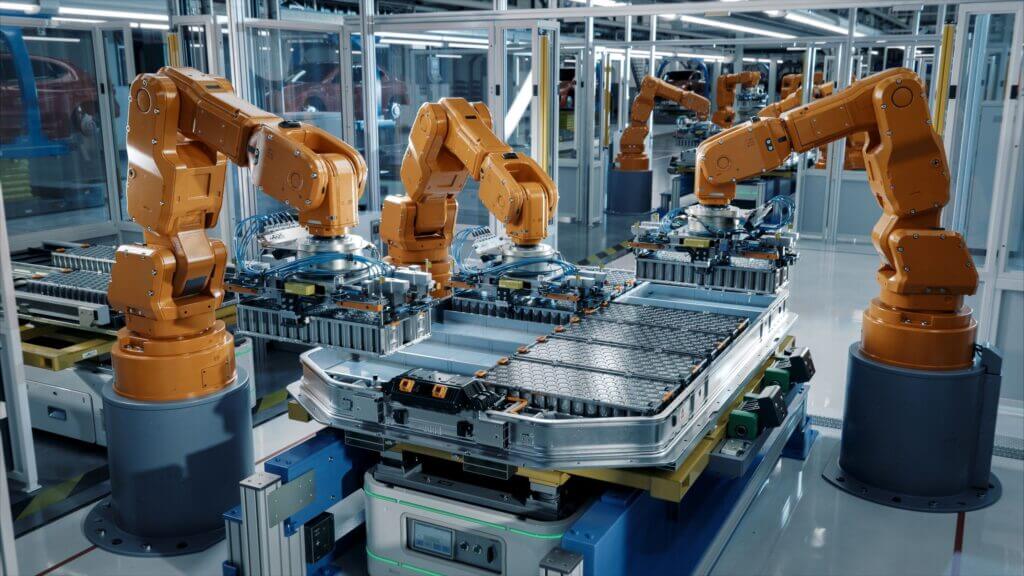

New data sheet outlines fire protection strategies for lithium-ion batteries

The worrying increase in lithium-ion battery fires has seen the delivery of a new data sheet outlining fire protection strategies for their storage. The information produced by FM Global, specifically Loss Prevention Data Sheet 7-112 (October 2024), provides detailed fire risk mitigation strategies for lithium-ion battery manufacturing and storage. It outlines objectives such as preventing […]

Supreme Court judgement has key implications for Professional Indemnity claims

A landmark Supreme Court judgement in favour of a housebuilding giant has significant implications for firms engaged in legacy projects who will now face renewed reputational and litigation risk, especially for high-rise or multi-occupancy residential buildings. The ruling in BDW Trading Ltd (Barratt) v URS Corporation Ltd has key repercussions for Professional Indemnity (PI ) […]

Professional Indemnity Insurance vital for Businesses

In an increasingly complex and litigious business environment, Professional Indemnity Insurance (PII) is no longer just a consideration it is a necessity. Whether you’re a consultant, contractor, designer, or adviser, even spurious allegations of a professional error or omission, can be very expensive to defend, let alone pay for damages that may be awarded. Last […]

Cyber criminals impersonating IT help desks to launch attacks

The National Cyber Security Centre (NCSC) has warned that criminals launching cyber-attacks at British retailers are impersonating IT help desks to break into organisations with Marks & Spencer, Co-op and Harrods targeted in the last two weeks. The Co-op apologised after hackers – who call themselves DragonForce – said they had stolen 20 million of […]

Contractor loses concrete deterioration legal case

A contractor who took a design firm to court has lost the case after a judge ruled construction errors were responsible for concrete deterioration problems. MJS Projects (March) Ltd took designers RPS Consulting Services Ltd to Leeds’ Technology and Construction Court for alleged negligence and breach of contract after concrete on its development deteriorated just […]

Alliance of international hackers launch weekly cyberattacks on UK

An alliance of pro-Russian and pro-Palestinian hackers is reportedly launching weekly cyberattacks against the UK’s state agencies, armed forces, infrastructure operators, councils and security services, including the MI6 website. The simultaneous attacks targeting the agencies’ websites were carried out last month, hacker Mr Hamza claimed on the Holy League coalition’s Telegram Channel. ‘Our message is clear: this […]

Reviewing insurance limits amid tariffs disruption key to avoiding underinsurance

Global businesses are navigating a volatile risk landscape with the reintroduction of tariffs—particularly those imposed by the Trump administration- reshaping global trade flows, increasing input costs, and triggering supply chain delays. Because of higher operational risks, increasing tariffs can have a domino effect on business insurance prices. The Lloyd’s Market Association has urged insurers to […]

Equipment Breakdown Insurance crucial to mitigating losses

Technology is advancing at an unprecedented rate, transforming the way businesses operate. Automation, artificial intelligence, and the Internet of Things (IoT) are driving efficiencies, but they are also increasing reliance on complex machinery and equipment. The more advanced and specialised the equipment, the higher the cost of repair or replacement when things go wrong. In […]

Heathrow shutdown highlights need for specialist insurance advice

The fire which forced the closure of Heathrow Airport and affected more than 200,000 airline passengers world-wide, is a timely reminder of the need for businesses to use a specialist broker to ensure sufficiency of insurance cover is in place. Risk managers should seek specialist advice about the breadth of insurance options available, not just […]