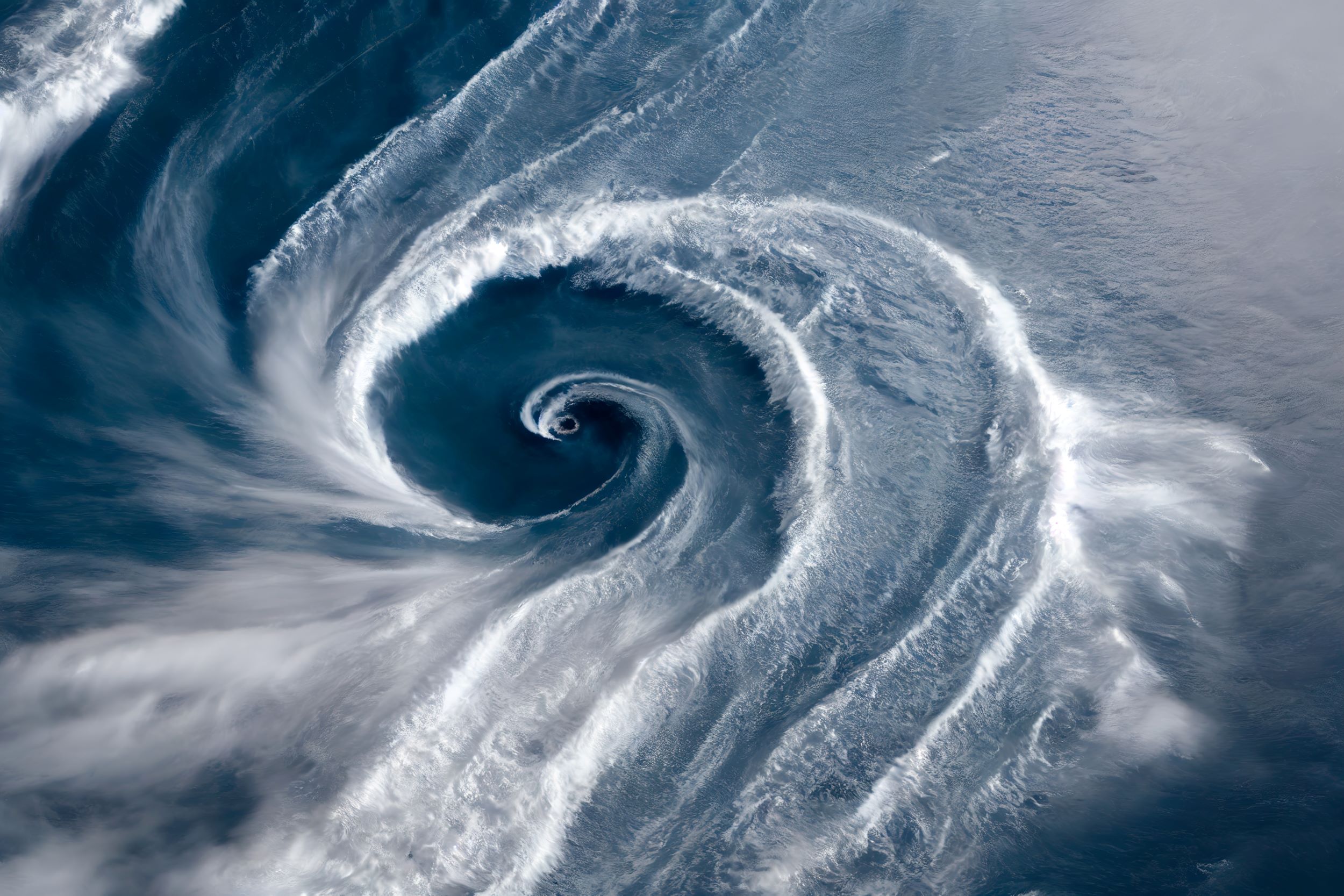

Satoru Komiya, the Tokio Marine President and Group CEO, believes natural catastrophes rather than a systemic cyber-attack remains the “biggest risk” to the insurance sector.

Komiya said the insurance company “cannot run away from” natural catastrophe risk despite deepening concerns among investors and policymakers over rising industry losses linked to climate change.

After successive years in which global claims from disasters such as hurricanes and wildfires topped £79billion ($100bllion), some big insurers have pulled out of climate-exposed areas while reinsurers have driven up their prices, fuelling worries climate change is making parts of the world uninsurable. It has been estimated that natural disasters in the first half of 2023 cost around £153billion ($194 billion) globally.

There are significant warnings from policymakers about an approaching “tipping point” when extreme weather caused by climate change makes insurance unavailable in certain regions.

The Bank for International Settlements has warned the risks that an “insurance market failure for climate-related risks” could spill over into a credit shock and force government to be insurers of last resort. “This trend, if left unabated, may lead to an insurance market failure for climate-related risks and ultimately force governments to become ‘insurers of last resort’,” researchers from BIS’s Financial Stability Institute said in a report.

The report also stated that a growing number of insurers are retreating from high-risk areas with trend likely to continue as insurers “gain greater awareness and knowledge in incorporating climate-related risks in their pricing and underwriting approaches.”

Such risks not only affect businesses with operations domiciled within regions prone to natural catastrophe, as the same risks also impact on global supply chains. Risk managers need to carefully work with a specialist broker to design a suitable insurance programme that includes insurers with strong balance sheets as well as insurance limits that are appropriate to cover major losses. Contingent business interruption exposures also need to be fully considered and factored in to the insurance programme design.

To discuss this further with a specialist broker at W Denis, please make arrangements with Daniel Moss at [email protected] or on 0044 (0)113 2439812.